- Start

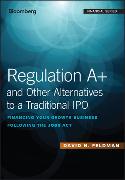

- Regulation A+ and Other Alternatives to a Traditional IPO

Regulation A+ and Other Alternatives to a Traditional IPO

Angebote / Angebote:

Praise for

Regulation A+ and Other Alternatives to a Traditional IPO

"I applaud David's book and the comprehensive overview he's provided surrounding alternative methods to the traditional IPO, such as Regulation A+, Reg. D and Reverse Mergers. OTC Markets Group strongly supports online capital raising, as we make it less painful for smaller companies to be public. Our vision is for transparent and technology-enabled public markets to be a competitive source of growth capital for successful and sustainable companies. This publication provides thoughtful context, relevance and insight to these newer capital raising tools."

-R. CROMWELL COULSON, President, Chief Executive Officer and Director of OTC Markets Group, Inc.

"A must-read guide for every CEO, CFO, and Board member of a company evaluating the options for raising growth capital in the public markets."

-PAUL R. GUDONIS, CEO, Myomo, Inc., the first company to complete a Regulation A+ IPO onto a national securities exchange

"David provides helpful historical context to explain the recent historic changes to securities laws and explains a complicated subject with ease. He also provides a fresh, thoughtful perspective on the state of Regulation A+ and other traditional IPO alternatives along with insights into what the future might hold. This book is a must-read for any securities attorney, investment bank, platform or entrepreneur who is considering utilizing Regulation A+."

-RYAN M. FEIT, CEO and Co-Founder, SeedInvest

"In all the writing about Regulation A, what we lack is context. Why did we need the revisions to this ancient regulation? What did 'Regulation A+' replace? What are the alternatives? This is the book that answers those questions and explains Regulation A's place in our ever-more-complex regulatory regime, written by someone with deep understanding of that context."

-SARA HANKS, CEO/Founder, CrowdCheck, Inc. and Co-Chair of the Securities and Exchange Commission's Advisory Committee on Small and Emerging Companies

Lieferbar in ca. 10-20 Arbeitstagen